The pressure on enterprises to achieve sustainability, especially in the area of carbon emissions, is perhaps as high as it has ever been. Headlines in general and trade media make it clear that many IT organizations are pursuing water and energy efficiencies but that industry growth makes sustainability a desirable, but very elusive, goal for many organizations years after the public, market and stockholders began demanding a more responsible approach to data center design and operation. Explosive data center growth only makes the task more difficult—and important RockScar believes that companies that take a holistic and global approach to organizational sustainability will realize a full array of benefits as well as reduced overall risk profile. The wide variety of articles available on the Digital Infra Network, 7x24Exchange, and Mission Critical websites depict an industry successfully pursuing resource and Net Zero carbon emission goals but also struggling to reach diversity and staffing targets. New money 0entering the industry in the form of investment funds (e.g. IPI, Madison Capital, and Blackstone Group) will certainly bring a higher level of scrutiny to data center operations and risk factors.

ORGANIZATIONAL SUSTAINABILITY IS A PRIORITY

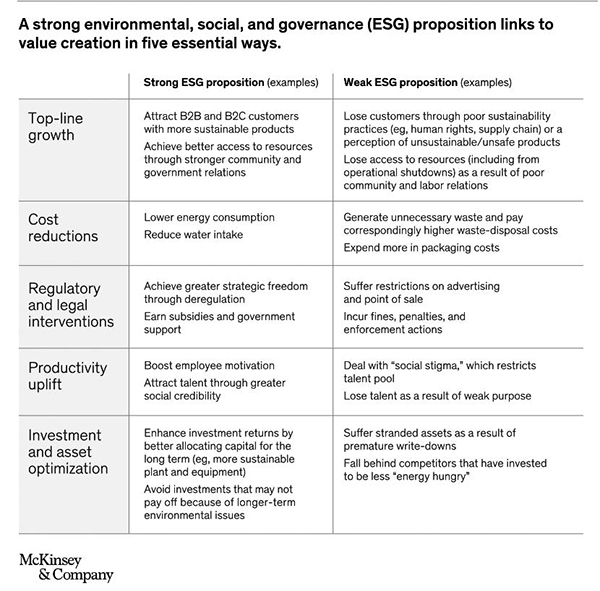

The case for organizational sustainability is very clear. Growth in ESG (environmental, social and governance) investments is skyrocketing, and these investors are becoming extremely restive when organizations are seen as moving too slowly. McKinsey reports that ESG links to cash flow in five important ways:

Data center operators can claim credit for reducing costs (#2) in individual facilities as well as optimizing investment and capital expenditures (#4), but only a few organizations act as though IT sustainability can spur top-line growth (#1), increase employee productivity and (#4) and minimize regulatory and legal interventions (#3). These latter few organizations take a wider view of sustainability and asking IT to support organization-wide sustainability efforts. For instance, a case study published in 2016 documented the extent of Raytheon’s sustainability program, in which IT helped the organization address concerns about supply chains, product development, conflict minerals and staffing.

This broad mandate demands that an organization have a strong governance plan that involves IT as an integral partner.

In other instances, organizations may fail at some or all of their sustainability objectives. This may indicate that:

WHAT IS SUSTAINABILITY?

A true sustainability (or ESG) plan should create long-term value for the organization by employing practices that are reliable, repeatable and profitable. That is why so many organizations focus on energy and resource conservation. Clearly operations that are overly dependent on finite resources such as fossil fuels and water will eventually have to adjust to environment conditions. Similarly, organizations that rely on rare materials, blood diamonds and other similarly sourced materials, slave or child labor and civil rights violators experience the risk of interrupted supply or increased cost because of military action, civil unrest or other conflict.

In practice, consumers and investors, as well as employees, are likely to turn away from organizations and products that engage in questionable business practices. These defections can cause financial loss or even endanger an entire company’s existence by reducing profits, increasing costs and even making recruiting more difficult. In addition, organizations that manage to high organizational standards will be better positioned to withstand shifts in the global economy, such as heightened legal obligations and international treaties. Consider, for example, the possible impact on organizations and executives of the Climate Neutral Data Centre Pact or the effort to make ecocide an international crime as part of the Rome Treaty.

RESOURCE MANAGEMENT: A SUCCESS STORY

The 2008 Report to Congress on Server and Data Center Energy Efficiency: Public Law 109-431 may have been the first alarm about the environmental consequences of data center operations. The report’s five possible energy use trend lines may have caused the industry to begin to consider how it might be damaging the environment.

Not long after, Greenpeace issued the first of its report cards, which challenged the industry leaders of the time to clean up their acts. In case anyone has forgotten, Greenpeace literally graded the largest IT companies of the time on their coal intensity, transparency, infrastructure siting and mitigation strategies. The report card included many As but many Ds and even more Fs.

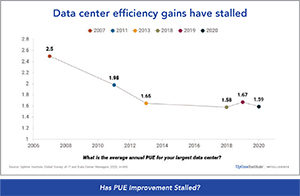

As could be expected, the industry responded, whether from fear of government regulation or more poor grades and bad publicity. For instance, average PUE, (a metric devised by The Green Grid in 2006) fell from 2.5 in 2007 to 1.65 in 2013, according to the Uptime Institute. Industry average PUEs have stagnated since 2013, perhaps indicating that the low hanging fruit was plucked in the beginning of the last decade.

Despite this failing, industry leaders continue to try to improve their environmental performance, with some increasing their use of renewable energy and others making use of renewable energy credits, which are intended to fund utility investment in solar, wind and other clean carbon free energy sources. These efforts are essential as IT demand and capacity continue to grow at unprecedented levels.

Microsoft and AWS have similar expectations.

Enterprise-owned and operated facilities are increasingly under pressure to meet expectations set by corporate leaders. In 2018, Uptime Institute discussed how stockholders and investment funds were playing increasingly large roles in setting these goals.

At that time, Uptime Institute quoted a groundbreaking 2016 letter in which Laurence Fink, the CEO of Blackrock, one of the largest global investment funds, was challenging CEOs on sustainability issues. Fink wrote, “Generating sustainable returns over time requires a sharper focus not only on governance, but also on environmental and social factors facing companies today… Over the long term, environmental, social and governance issues—ranging from climate change to diversity to board effectiveness— have real and quantifiable financial impacts. At companies where ESG issues are handled well, they are often a signal of operation excellence.” This viewpoint, though viewed skeptically by some, has since been validated by events, with hedge fund investor Engine 1 succeeding in electing three directors to ExxonMobil’s board because of the company’s poor performance and environmental policies.

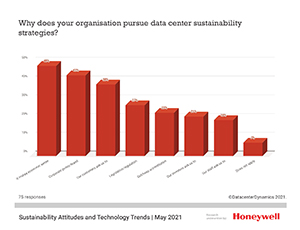

Stockholder pressure on corporate boards is only accelerating, with McKinsey reporting, “Global sustainable investment now tops $30 trillion—up 68 percent since 2014 and tenfold since 2004.” And a May 2020 Honeywell survey finds that companies are feeling their influence, with 21% of respondents reporting that investor influence drives sustainability efforts. Another 43% say sustainability is corporate policy, but these policies can and are driven by investors.

MORE CHANGE TO COME

Given the continued rapid growth of the industry, data center owners and operators will have to keep working hard to increase efficiency of not only its own operators but across the entire enterprise. CIOs and CSOs can enable their IT operations to own, track and innovate ideas that will reduce overall carbon use, even if it means slight increases in IT energy.

In addition, IT can help in product design and supply chain monitoring so that new product design, manufacturing, packaging and shipping require minimal resources. Both these steps are achievable, but only if CIOs and CSOs are truly acting at the highest levels of authority.

However, ESG investors will continue to exert top-down pressure on C-level executives, and their concerns extend far beyond resource consumption and sourcing. Blackstone, for instance, articulates stances on diversity and inclusion, improved access to healthcare and support for US military veterans.

This listing from the CFA institute suggests some of the other new pressures that will eventually find their way into data center management.

CFA notes that there is no one exhaustive list of ESG examples. ESG factors are often interlinked, and it can be challenging to classify an ESG issue as only an environmental, social, or governance issue, as the lists below show. ESG factors can often be measured (e.g., what is the employee turnover for a company), but it can be difficult to assign them a monetary value (e.g., what is the cost of employee turnover for a company).

ENVIRONMENTAL

Conservation of the natural world

SOCIAL

Consideration of people & relationships

GOVERNANCE

Standards for running a company

The United Nations maintains its own list of 17 sustainability goals and recently held a conference, “High-level Political Forum for the Sustainable Development Goals” (July 6-16) to discuss progress and needed actions. See the website for more detail. Not all data center owners and operators may see a connection between their work and all of these goals, but some communities will, which may impact the overall enterprise.

In a sense, though, data centers are already experiencing some of the pangs that result from a widespread lack of sustainability, as some of the industry’s skill shortage can be attributed to poverty and poor education.

ESG investor concerns about diversity and inclusion have the potential to radically reshape industry discussions and practices about the skills shortage, caused, in part, by a large cohort of workers set to retire at the same time the industry needs ever more workers.

ESG investors are less likely than industry veterans to see staffing shortages as unique to IT verticals and more likely to see them as part of national and even global discussions of diversity, inclusion and fairness, especially at a time when industries and verticals in many countries and regions find themselves facing low levels of unemployment and low numbers of “qualified” candidates. They are far more likely to see efforts to attract new candidate pools using complex job taxonomies as ill-fated, unless also accompanied by efforts to improve work environments, including salary and benefits as well as remote work and child and family care options.

CONCLUSION

The industry’s efforts at curbing resource use, mostly through efficiency, have been exemplary. But more will be expected as organizations build larger and more resource-intensive facilities in more places, attracting the attention of more regulators and even larger investors. Companies that understand organizational sustainability will be better positioned against new and developing risks.

The factors to consider when evaluating an organization’s sustainability risks range from resource consumption and carbon to workplace diversity and even education and equality.

Kevin Heslin is Partner at RockScar. He can be reached at [email protected].